Use these links to rapidly review the documentTable of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

Definitive Proxy Statement | ||

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| SKYWORKS SOLUTIONS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

March 31, 2016PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

April , 2018

Dear Stockholder:

I am pleased to invite you to attend the 20162018 Annual Meeting of stockholdersStockholders of Skyworks Solutions, Inc. to be held at 2:00 p.m., local time, on Wednesday, May 11, 2016,9, 2018, at the Boston Marriott Burlington, 1 Burlington Mall Road, Burlington, Massachusetts (the "Annual Meeting"“Annual Meeting”). We look forward to your participation in person or by proxy. The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe the matters that we expect to be acted upon at the Annual Meeting.

If you plan to attend the Annual Meeting, please check the designated box on the enclosed proxy card. Or, if you utilize our telephone or Internet proxy submission methods, please indicate your plans to attend the Annual Meeting when prompted to do so. If you are a stockholder of record, you should bring the top half of your proxy card as your admission ticket and present it upon entering the Annual Meeting. If you are planning to attend the Annual Meeting and your shares are held in "street name"“street name” by your broker (or other nominee), you should ask the broker (or other nominee) for a proxy issued in your name and present it at the meeting.

Whether or not you plan to attend the Annual Meeting, and regardless of how many shares you own, it is important that your shares be represented at the Annual Meeting. Accordingly, we urge you to complete the enclosed proxy and return it to us promptly in the postage-prepaid envelope provided, or to complete and submit your proxy by telephone or via the Internet in accordance with the instructions on the proxy card. If you do attend the Annual Meeting and wish to vote in person, you may revoke a previously submitted proxy at that time by voting in person at the meeting.

Sincerely yours,

David J. AldrichChairman and Chief Executive Officer

| Sincerely yours,  David J. Aldrich Chairman of the Board and Executive Chairman |

| | | | |

| | | | |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

Skyworks Solutions, Inc.

| 20 Sylvan Road Woburn, MA 01801 (781) 376-3000 | | 5221 California Avenue Irvine, CA 92617 (949) 231-3000 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSNotice of Annual Meeting of StockholdersTO BE HELD ON WEDNESDAY, MAY 11, 2016To Be Held on Wednesday, May 9, 2018

To the Stockholders of Skyworks Solutions, Inc.:

The 20162018 Annual Meeting of stockholdersStockholders of Skyworks Solutions, Inc., a Delaware corporation (the "Company"“Company”), will be held at 2:00 p.m., local time, on Wednesday, May 11, 2016,9, 2018, at the Boston Marriott Burlington, 1 Burlington Mall Road, Burlington, Massachusetts (the "Annual Meeting"“Annual Meeting”) to consider and act upon the following proposals:

2018;

5. To approve an amendment to the Company's Restated Certificate of Incorporation to eliminate the supermajority vote provisions relating to stockholder approval of a merger or consolidation, disposition of all or substantially all of the Company's assets, or issuance of a substantial amount of the Company's securities;

stockholders, and

7. To approve an amendment to the Company's Restated Certificate of Incorporation to eliminate the supermajority vote provision relating to stockholder amendment of charter provisions governing directors;

8. To approve an amendment to the Company's Restated Certificate of Incorporation to eliminate the supermajority vote provision relating to stockholder amendment of the charter provision governing action by stockholders; and

9.

Only stockholders of record at the close of business on March 17, 2016,15, 2018, are entitled to notice of and to vote at the Annual Meeting.To ensure your representation at the Annual Meeting, we urge you to submit a proxy promptly in one of the following ways whether or not you plan to attend the Annual Meeting: (a) by completing, signing, and dating the accompanying proxy card and returning it in the postage-prepaid envelope enclosed for that purpose; (b) by completing and submitting your proxy using the toll-free telephone number listed on the proxy card; or (c) by completing and submitting your proxy via the Internet by visiting the website address listed on the proxy card. The Proxy Statement accompanying this notice describes each of the items of business listed above in more detail. Our Board of Directors recommends: a vote "“FOR"” the election of the nominees for director named in Proposal 1 of the Proxy Statement; a vote “"FOR"FOR” Proposal 2, ratifying the selection of KPMG LLP as the independent registered public accounting firm of the Company for fiscal year 2016;2018; a vote "“FOR"” Proposal 3, approving, on an advisory basis, the compensation of the Company'sCompany’s named executive officers; a vote “FOR” Proposal 4, approving the Amended and Restated 2008 Director Long-Term Incentive Plan, as Amended; and a vote "“FOR" each of Proposals 4–8, approving amendments” Proposal 5, ratifying the amendment to the Company's Restated Certificate of Incorporation.Company’s By-laws.

| By Order of the Board of Directors, | ||

ROBERT J. TERRY | ||

Senior Vice President, General Counsel and Secretary |

Woburn, MassachusettsMarch 31, 2016

| | | | |

|

|

|

|

|

|

|

|

|

|

| | | |

|

Proxy Statement 2018

| 20 Sylvan Road Woburn, MA 01801 (781) 376-3000 | | 5221 California Avenue Irvine, CA 92617 (949) 231-3000 |

Proxy Statement

2018 Annual Meeting of Stockholders

![]()

Table of Contents |

Proxy Statement2016 Annual Meeting of Stockholders

General Information | 11 | |||

| 15 | |||

Election of Directors | ||||

Nominees for Election | ||||

Corporate Governance | ||||

Committees of the Board of Directors | ||||

Role of the Board of Directors in Risk Oversight | 26 | |||

Compensation Committee Interlocks and Insider Participation | 26 | |||

Certain Relationships and Related Person Transactions | ||||

| 27 | |||

Audit Fees | 28 | |||

| 29 | |||

| 30 | |||

| 31 | |||

Summary and Highlights | ||||

Compensation Discussion and Analysis | ||||

Compensation Tables for Named Executive Officers | ||||

Director Compensation | 53 |

| Compensation Committee Report | 55 | |||

Proposal 4: Approval of the Company’s Amended and Restated 2008 Director Long-Term Incentive Plan, as Amended | 56 | |||

Description of the Amended 2008 Director Plan | 57 | |||

New Plan Benefits | 61 | |||

Existing Plan Benefits | 62 | |||

Equity Compensation Plan Information | ||||

Proposal 5: Advisory Vote to Ratify the Stockholder Special Meeting Provision in the Company’s By-laws

| 64 | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| 66 | |||

Other Proposed Action | 68 | |||

Other Matters | 68 | |||

Appendix A: Stockholder Special Meeting Provision (Article II, Section 3, of the Company’s By-laws) | 70 | |||

Appendix B: Unaudited Reconciliations of Non-GAAP Financial Measures | 73 | |||

| ||||

| 75

| ||||

|

| | | | |

| | | | |

How do we refer to Skyworks in this Proxy Statement?

The terms "Skyworks," "the“Skyworks,” “the Company," "we," "us,"” “we,” “us,” and "our"“our” refer to Skyworks Solutions, Inc., a Delaware corporation, and its consolidated subsidiaries.

When and where is our Annual Meeting?

The Company's 2016Company’s 2018 Annual Meeting of stockholdersStockholders is to be held on Wednesday, May 11, 2016,9, 2018, at the Boston Marriott Burlington, 1 Burlington Mall Road, Burlington, Massachusetts, at 2:00 p.m., local time, or at any adjournment or postponement thereof (the "Annual Meeting"“Annual Meeting”).

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will consider and vote on the following matters:

The stockholders will also act on any other business that may properly come before the meeting.

What is included in our proxy materials?

The Company'sCompany’s Annual Report, which includes financial statements and "“Management'sManagement’s Discussion and Analysis of Financial Condition and Results of Operation"” for the fiscal year ended October 2, 2015 ("September 29, 2017 (“fiscal year 2015"2017”), is being mailed together with this Proxy

Statement to all stockholders of record entitled to vote at the Annual Meeting. This Proxy Statement and form of proxy are being first mailed to stockholders on or about March 31, 2016.April , 2018. The Proxy Statement and the Company'sCompany’s Annual Report are available athttp://www.skyworksinc.com/annualreport.

Who can vote at our Annual Meeting?

Only stockholders of record at the close of business on March 17, 201615, 2018 (the "Record Date"“Record Date”), are entitled to notice of and to vote at the Annual Meeting. As of March 17, 2016,15, 2018, there were 190,124,414182,165,379 shares of Skyworks'Skyworks’ common stock issued and outstanding. Pursuant to Skyworks'Skyworks’ Restated Certificate of Incorporation and By-laws, and applicable Delaware law, each share of common stock entitles the holder of record at the close of business on the Record Date to one vote on each matter considered at the Annual Meeting.

Yes. Your vote is important no matter how many shares you own. Please take the time to vote in the way that is easiest and most convenient for you, and cast your vote as soon as possible.

How do I vote if I am a stockholder of record?

As a stockholder of record, you may vote in one of the following three ways whether or not you plan to attend the Annual Meeting: (a) by completing, signing, and dating the accompanying proxy card and returning it in the postage-prepaid envelope enclosed for that

|

|

|

|

|

|

|

|

|

|

purpose, (b) by completing and submitting your proxy using the toll-free telephone number listed on the proxy card, or (c) by completing and submitting your proxy via the Internet at the website address listed on the proxy card. If you attend the Annual Meeting, you may vote in person at the Annual Meeting even if you have previously submitted your proxy by mail, telephone, or via the Internet (and your vote at the Annual Meeting will automatically revoke your previously submitted proxy, although mere attendance at the meeting without voting in person will not have that result).

How do I vote if I am a beneficial owner of shares held in "street name"“street name”?

If your shares are held on your behalf by a third party such as your broker or another person or entity who holds shares of the Company on your behalf and for your

| | | | |

| | - Proxy Statement - | | Page 11 |

benefit, which person or entity we refer to as a "nominee,"“nominee,” and your broker (or other nominee) is the stockholder of record of such shares, then you are the beneficial owner of such shares and we refer to those shares as being held in "street“street name."” As the beneficial owner of your "street name"“street name” shares, you are entitled to instruct your broker (or other nominee) as to how to vote your shares. Your broker (or other nominee) will provide you with information regarding how to instruct your broker (or other nominee) as to the voting of your "street name"“street name” shares.

How do I vote if I am a participant in the Skyworks 401(k) Savings and Investment Plan?

If you are a participant in the Skyworks 401(k) Savings and Investment Plan (the "401(k) Plan"“401(k) Plan”), you will receive an instruction card for the Skyworks shares you own through the 401(k) Plan. That instruction card will serve as a voting instruction card for the trustee of the 401(k) Plan, and your 401(k) Plan shares will be voted as you instruct.

Can I change my vote after I have voted?

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted at the Annual Meeting. Proxies may be revoked by (a) delivering to the Secretary of the Company, before the taking of the vote at the Annual Meeting, a

written notice of revocation bearing a later date than the proxy, (b) duly completing a later-dated proxy relating to the same shares and presenting it to the Secretary of the Company before the taking of the vote at the Annual Meeting, or (c) attending the Annual Meeting and voting there in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice of revocation or subsequent proxy should be delivered to the Company's principalCompany’s executive offices at Skyworks Solutions, Inc., 20 Sylvan Road, Woburn, MA 01801,5221 California Avenue, Irvine, CA 92617, Attention: Secretary, or hand delivered to the Secretary of the Company, before the taking of the vote at the Annual Meeting.

Can I attend the Annual Meeting?

If you plan to attend the Annual Meeting, please be sure to indicate your intent to attend by checking the designated box on your proxy card if you are submitting a proxy via mail, or by indicating when prompted if you are submitting a proxy through either Skyworks'Skyworks’ telephone or Internet proxy submission procedures. In either case, save the admission ticket attached to your proxy (the top half) and bring that with you to the

Annual Meeting. If your shares are held in "street name"“street name” by your broker (or other nominee), you should consult your instruction card to determine how to indicate your intent to attend the Annual Meeting. If your instruction card does not provide any such indication, you should contact your broker (or other nominee) to determine what you will need to do to be able to attend and vote at the Annual Meeting. In order to be admitted to the Annual Meeting, you will need to present your admission ticket or the appropriate documentation from your broker (or other nominee), as well as provide valid picture identification, such as a driver'sdriver’s license or passport.

If I vote by proxy, how will my vote be cast?

The persons named as attorneys-in-fact in this Proxy Statement, DavidLiam K. Griffin and Robert J. Aldrich and Mark V.B. Tremallo,Terry, were selected by the Board of Directors and are officers of the Company. As attorneys-in-fact, Messrs. AldrichGriffin and TremalloTerry will vote any shares represented at the meeting by proxy. Each executed proxy card returned by a stockholder of record or proxy vote recorded via telephone or the Internet by a

|

|

|

|

|

|

|

|

|

|

stockholder of record in the manner provided on the proxy card prior to the taking of the vote at the Annual Meeting will be voted. Where a choice has been specified in an executed proxy with respect to the matters to be acted upon at the Annual Meeting, the shares represented by the proxy will be voted in accordance with the choices specified.

How will my shares be voted if I do not give specific voting instructions when I deliver my proxy?

If you are a stockholder of record and deliver a proxy but do not give specific voting instructions, then the proxy holders will vote your shares as recommended by the Board of Directors.

If your shares are held in "street“street name,"” your broker (or other nominee) is required to vote those shares in accordance with your instructions. If you do not give instructions to your broker (or other nominee), your broker (or other nominee) will only be entitled to vote your shares with respect to "discretionary"“discretionary” matters, as described below, but will not be permitted to vote the shares with respect to "non-discretionary"“non-discretionary” matters.If you beneficially own shares that are held in "street name"“street name” by your broker (or other nominee), we strongly encourage you to provide instructions to your broker (or other nominee) as to how to vote on the election of directors and all of the Proposals by signing, dating, and returning to your broker (or other nominee) the instruction card provided by your broker (or other nominee).

| | | | |

Page 12 | | - Proxy Statement - | | |

If you are a participant in the 401(k) Plan, the trustee of the 401(k) Plan will not vote your 401(k) Plan shares if the trustee does not receive voting instructions from you by 11:59 p.m. Eastern Time on May 6, 2016,4, 2018, unless otherwise required by law.

What is a "broker non-vote"“broker non-vote”?

A "broker non-vote"“broker non-vote” occurs when your broker (or other nominee) submits a proxy for your shares (because the broker (or other nominee) has either received instructions from you on one or more proposals, but not all, or has not received instructions from you but is entitled to vote on a particular "discretionary"“discretionary” matter) but does not indicate a vote "“FOR"” a particular proposal because the broker (or

other nominee) either does not have authority to vote on that proposal and has not received voting instructions from you or has "discretionary"“discretionary” authority on the proposal but chooses not to exercise it. "Broker non-votes"“Broker non-votes” are not counted as votes "“FOR"” or "“AGAINST"” the proposal in question or as abstentions, nor are they counted to determine the number of votes present for the particular proposal. We do, however, count "broker non-votes"“broker non-votes” for the purpose of determining a quorum for the Annual Meeting. If your shares are held in "street name"“street name” by your broker (or other nominee), please check the instruction card provided by your broker (or other nominee) or contact your broker (or other nominee) to determine whether you will be able to vote by telephone or via the Internet.

What vote is required for each matter?

Election of Directors. Pursuant to the Company'sCompany’s By-laws, a nominee will be elected to the Board of Directors if the votes cast "“FOR"” the nominee'snominee’s election at the Annual Meeting exceed the votes cast "“AGAINST"” the nominee'snominee’s election (as long as the only director nominees are those individuals set forth in this Proxy Statement). Abstentions and "broker non-votes"“broker non-votes” will not count as votes "“FOR"” or "“AGAINST."” If the shares you own are held in "street“street name,"” your broker (or other nominee), as the record holder of your shares, is required to vote your shares according to your instructions. Because Proposal 1 constitutes an uncontested election of directors (an election where the number of nominees for election as directors is equal to or less than the number of directors to be elected), it isnot considered to be a "discretionary"“discretionary” matter for certain brokers.If you do not instruct your broker how to vote with respect to this item, your broker may not vote your shares with respect to the election of directors. In such case, a "broker non-vote"“broker non-vote” may occur, which will have no effect on the outcome of Proposal 1.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares

present in person, or represented by proxy at the Annual Meeting, and entitled to vote on such matter at the Annual Meeting, is required to approve Proposal 2. Proposal 2 involves a matter on which a broker (or other nominee)does have "discretionary"“discretionary” authority to vote.Even ifIf you do not instruct your broker how to vote with respect to this

|

|

|

|

|

|

|

|

|

|

item, your broker may still vote your shares with respect to this proposal in its discretion. With respect to Proposal 2, a vote of "“ABSTAIN"” will have the same effect as a vote of "“AGAINST."”

Say-on-Pay Vote.Vote; Approval of Amended and Restated 2008 Director Long-Term Incentive Plan, as Amended; Ratification of Amendment to By-laws. The affirmative vote of a majority of the shares present in person, or represented by proxy at the Annual Meeting, and entitled to vote on such matter at the Annual Meeting, is required to approve Proposal 3. ProposalProposals 3, is4, and 5. Proposals 3, 4, and 5 arenot considered to be a "discretionary"“discretionary” matter for certain brokers.If you do not instruct your broker how to vote with respect to this item,these items, your broker may not vote your shares with respect to this proposal.these proposals. In such case, a "broker non-vote"“broker non-vote” may occur, which will have no effect on the outcome of Proposal 3.Proposals 3, 4, and 5. Votes that are marked "“ABSTAIN"” are counted as present and entitled to vote with respect to ProposalProposals 3, 4, and 5, and will have the same impact as a vote that is marked "“AGAINST"” for purposes of Proposal 3.Proposals 3, 4, and 5.

Approval of Amendments to the Company's Restated Certificate of Incorporation. Approval of Proposals 4, 5, 6, 7, and 8, requires the affirmative vote of the holders of at least the following percentages of the shares of our outstanding common stock, respectively: 662/3%, 80%, 90%, 80%, and 80%. Proposals 4–8 arenot considered to be "discretionary" matters for certain brokers.If you do not instruct your broker how to vote with respect to one or more of these items, your broker may not vote your shares with respect to such proposals. In such case, a "broker non-vote" may occur, which will have no effect on the outcome of such proposal. Votes that are marked "ABSTAIN" as to any of Proposals 4–8 are counted as present and entitled to vote with respect to such proposal and will have the same impact as a vote that is marked "AGAINST" for purposes of such proposal.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote:

FOR the election of each of the eightnine director nominees (Proposal 1).

FOR the ratification of the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 20162018 (Proposal 2).

FOR the approval, on a non-binding basis, of the compensation of our Named Executive Officers, as described below under "“Compensation Discussion and Analysis,"” and in the executive compensation tables and accompanying narrative disclosures (Proposal 3).

FOR the approval of amendmentsthe Company’s Amended and Restated 2008 Director Long-Term Incentive Plan, as Amended (Proposal 4).

FOR the ratification of an amendment to the Company'sCompany’s Third Amended and Restated CertificateBy-laws that provides the Company’s stockholders the right to request a special meeting of Incorporation (Proposals 4–8)stockholders (Proposal 5).

| | | | |

| | - Proxy Statement - | | Page 13 |

How will the votes cast at our Annual Meeting be counted?

An automated system administered by the Company'sCompany’s transfer agent tabulates the votes at the Annual Meeting. The vote on each matter submitted to stockholders will be tabulated separately.

Where can I find the voting results of our Annual Meeting?

We expect to announce the preliminary voting results at our Annual Meeting. The final voting results will be reported in a Current Report on Form 8-K that will be filed with the Securities and Exchange Commission (the "SEC"“SEC”) within four business days after the end of our Annual Meeting and will be posted on our website.

Will my vote be kept confidential?

Yes. We will keep your vote confidential unless (1) we are required by law to disclose your vote (including in connection with the pursuit or defense of a legal or administrative action or proceeding), or (2) there is a contested election for the Board of Directors. The inspector of elections will forward any written comments that you make on the proxy card to management without providing your name, unless you expressly request on your proxy card that your name be disclosed.

What is the quorum requirement for our Annual Meeting?

The holders of a majority of the issued and outstanding stock of the Company present either in person or by proxy at the Annual Meeting constitute a quorum for the transaction of business at the Annual Meeting. Shares that abstain from voting on any

|

|

|

|

|

|

|

|

|

|

proposal and "broker non-votes"“broker non-votes” will be counted as shares that are present for purposes of determining whether a quorum exists at the Annual Meeting. If a "broker non-vote"“broker non-vote” occurs with respect to any shares of the Company'sCompany’s common stock on any matter, then those shares will be treated as not present and not entitled to vote with respect to that matter (even though those shares are considered entitled

to vote for purposes of determining whether a quorum exists because they are entitled to vote on other matters) and will not be voted.

When will Skyworks next hold an advisory vote on the frequency of say-on-pay votes?

Skyworks currently conducts an annual say-on-pay vote. The next advisory vote on the frequency of say-on-pay votes willis expected to be held at our 20172023 Annual Meeting of stockholders.Stockholders.

What is "householding"“householding”?

Some brokers (or other nominees) may be participating in the practice of "householding"“householding” proxy statements and annual reports. This means that only one copy of this Proxy Statement and our Annual Report

may have been sent to multiple stockholders in your household. If you are a stockholder and your household or address has received only one Annual Report and one Proxy Statement, the Company will promptly deliver a separate copy of the Annual Report and the Proxy Statement to you, upon your written request to Skyworks Solutions, Inc., 20 Sylvan Road, Woburn, MA 01801,5221 California Avenue, Irvine, CA 92617, Attention: Investor Relations, or oral request to Investor Relations at (781) 376-3405.(949) 231-3433. If you would like to receive separate copies of our Annual Report and Proxy Statement in the future, you should direct such request to your broker (or other nominee). Even if your household or address has received only one Annual Report and one Proxy Statement, a separate proxy card should have been provided for each stockholder account. Each individual proxy card should be signed, dated, and returned in the enclosed postage-prepaid envelope (or completed and submitted by telephone or via the Internet, as described on the proxy card). If your household has received multiple copies of our Annual Report and Proxy Statement, you can request the delivery of single copies in the future by contacting your broker (or other nominee), or the Company at the address or telephone number above.

| | | | | ||

|

|

| | | | |

Proposal 1:

Election of Directors

Under this Proposal 1, you are being asked to consider eightnine nominees for election to our Board of Directors (all of our currently serving directors) to serve until the 20172019 Annual Meeting of stockholdersStockholders and until their successors are elected and qualified or until their earlier resignation or removal. The names of the eightnine nominees for election as directors, their current positions and offices, the year such nominees were first elected as directors of the Company and their Board committee memberships are set forth in the table below. Each nominee for election has agreed to serve if elected, and the Board of Directors knows of no reason why any nominee should be unable or unwilling to serve. If a nominee is unable or unwilling to serve, the attorneys-in-fact named in this Proxy Statement will vote any shares represented at the meeting by proxy for the election of another individual nominated by the Board of Directors, if any. No nominee or executive officer is related by blood, marriage, or adoption to any other director, nominee, or executive officer. No arrangements or understandings exist between any director or person nominated for election as a director and any other person pursuant to which such person is to be selected as a director or nominee for election as a director.

Nominee | Position(s) with the Company | First Year of Service | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

David J. Aldrich | Chairman of the Board and | 2000 | ||||||||||||||||||||

David J. McLachlan | Lead Independent Director | 2000 | M | | M | |||||||||||||||||

Kevin L. Beebe | Director | 2004 | M | M | ||||||||||||||||||

Timothy R. Furey | Director | 1998 | | M | M | |||||||||||||||||

Liam K. Griffin | President, Chief Executive Officer, and Director | 2016 | ||||||||||||||||||||

Balakrishnan S. Iyer | Director | 2002 | M | | C | |||||||||||||||||

Christine King | Director | 2014 | ||||||||||||||||||||

David P. McGlade | Director | 2005 | | M | M | |||||||||||||||||

Robert A. Schriesheim | Director | 2006 | C | |||||||||||||||||||

| | | | | | | | | | | | ||||||||||||

"C"“C” indicates Chair and "M"“M” indicates Member of the respective committee

Immediately below this proposal is biographical information about each of the director nominees, including information regarding each nominee'snominee’s business experience for the past five years, and the names of other public companies for which each nominee has served as a director during the past five years. The information presented below regarding the specific experience, qualifications, attributes, and skills of each nominee led our Nominating and Corporate Governance Committee and our Board of Directors to conclude that he or she should serve as a director. In addition, we believe that all of our nominees have integrity, business acumen, good judgment, knowledge of our business and industry, experience in one or more areas relevant to our business and strategy, and the willingness to devote the time needed to be an effective director.

Majority Vote Standard for Election of Directors

A nominee for election as a director in an uncontested election (an election where the number of nominees for election as directors is equal to or less than the number of directors to be elected) will be elected if the number of votes cast "“FOR"” such nominee'snominee’s election exceed the number of votes cast "“AGAINST"” the nominee'snominee’s election. In a contested election (in which the number of nominees for election as directors exceeds the number of directors to be elected at such meeting), directors are elected by a plurality of all votes cast in such election.

| | | | |

| | - Proxy Statement - | | Page 15 |

The election of directors at this Annual Meeting will beis uncontested. As a result, each nominee for election as a director at the Annual Meeting will only be elected if the votes cast "“FOR"” such nominee exceed the number of votes cast "“AGAINST"” such nominee. As required by our corporate governance guidelines, which are available on the

|

|

|

|

|

|

|

|

|

|

Investor Relations portion of the Company'sCompany’s website athttp://www.skyworksinc.com, each incumbent director who is a nominee for election as a director at the Annual Meeting submitted to the Board of Directors an irrevocable resignation that would become effective if the votes cast "“FOR"” such nominee'snominee’s election do not exceed the votes cast "“AGAINST"” such nominee'snominee’s election and our Board of Directors determines to accept his or her resignation. Upon such resignation by a nominee and pursuant to the procedures set forth in the corporate governance guidelines, the Nominating and Corporate Governance Committee will evaluate the best interests of our Company and stockholders and will recommend to our Board of Directors the action to be taken with respect to the resignation. The Board of Directors will then decide whether to accept, reject, or modify the Nominating and Corporate Governance Committee'sCommittee’s recommendation, and the Company will publicly disclose such decision by the Board of Directors with respect to the director nominee.

Shares represented by all proxies received by the Board of Directors that are properly completed, but do not specify a choice as to the election of directors, and are not marked as to withhold authority to vote for the nominees, will be voted "“FOR"” the election of all eightnine of the nominees.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE "“FOR"” THE ELECTION OF EACH OF THE EIGHTNINE NOMINEES IN PROPOSAL 1

David J. Aldrich, age 59, serves61, has served as Chairman of the Board and Executive Chairman since May 2016. Previously, he served as Chairman of the Board and Chief Executive Officer of the Company. From April 2000 until his election as Chairman infrom May 2014 Mr. Aldrich servedto May 2016 and as President and Chief Executive Officer and as a director of the Company.from April 2000 to May 2014. From September 1999 to April 2000, Mr. Aldrich served as President and Chief Operating Officer. From May 1999 to September 1999, Mr. Aldrichhe served as Executive Vice President, and from May 1996 to May 1999, Mr. Aldrichhe served as Vice President and General Manager of the semiconductor products business unit. Mr. Aldrich joined the Company in 1995 as Vice President, Chief Financial Officer and Treasurer. From 1989Prior to 1995, Mr. Aldrichjoining Skyworks, he held senior management positions at Adams-Russell Company and M/A-COM, Inc. (a developer and manufacturer of radio frequency and microwave semiconductors, components, and IP networking solutions), including Manager of Integrated Circuits Active Products, Corporate Vice President of Strategic Planning, Director of Finance and Administration and Director of Strategic Initiatives with the Microelectronics Division. Mr. Aldrich has also served since February 2007serves as a director of Belden Inc. (a publicly traded designerprovider of end-to-end signal transmission solutions) and manufacturerAcacia Communications, Inc. (a publicly traded provider of cable products and transmission solutions)high-speed coherent optical interconnect products).

We believe that Mr. Aldrich who has led Skyworks for more than 15 years, is qualified to serve as a director because of his leadership experience, his strategic decision making ability, his knowledge of the semiconductor industry and his in-depth knowledge of Skyworks'Skyworks’ business. Mr. Aldrich brings to the Board of Directors his thorough knowledge of Skyworks'Skyworks’ business, strategy, people, operations, competition, financial position, and investors. Further, as a result of his service as a director for Belden Inc. and Acacia Communications, Inc., a multinational public company,companies, Mr. Aldrich provides the Board of Directors with anotherother organizational perspectiveperspectives and other cross-board experience.

David J. McLachlan, age 77,79, has been a director since 2000 and Lead Independent Director since May 2014. He served as Chairman of the Board from May 2008 to May 2014. Mr. McLachlan served as a senior advisor to the Chairman and Chief Executive Officer of Genzyme Corporation (a publicly traded biotechnology company) from 1999 to 2004. He also was the Executive Vice President and Chief Financial Officer of Genzyme from 1989 to 1999. Prior to joining Genzyme, Mr. McLachlan served as Vice President and Chief Financial Officer of Adams-Russell Company (an electronic component supplier and cable television franchise owner). He previously served as a director of Dyax Corp. until January 2016, when it was acquired by Shire plc.

We believe that Mr. McLachlan, the current Lead Independent Director, is qualified to serve as a director because he possesses a broad range of business experience as a result of his service as both chief financial officer and director for several public companies. In particular, Mr. McLachlan has in-depth experience handling complex

|

|

|

|

|

|

|

|

|

|

accounting and finance issues for a broad range of companies. He has also served on the boards and audit and governance committees of other public companies (including as chairman of the audit committee), and serves as a designated "audit“audit committee financial expert"expert” for Skyworks'Skyworks’ Audit Committee. In addition, Mr. McLachlan has extensive knowledge regarding Skyworks' business, which he has acquired by serving for more than 15 years on the Board

| | | | |

Page 16 | | - Proxy Statement - | | |

Kevin L. Beebe, age 57,59, has been a director since January 2004. Since November 2007, he has been President and Chief Executive Officer of 2BPartners, LLC (a partnership that provides strategic, financial, and operational advice to private equity investors and management). In 2014, Mr. Beebe became a founding partner of Astra Capital Management (a private equity firm based in Washington, D.C.). Previously, beginning in 1998, he was Group President of Operations at ALLTEL Corporation (a telecommunications services company). From 1996 to 1998, Mr. Beebe served as Executive Vice President of Operations for 360° Communications Co. (a wireless communication company). He has held a variety of executive and senior management positions at several divisions of Sprint, including Vice President of Operations and Vice President of Marketing and Administration for Sprint Cellular, Director of Marketing for Sprint North Central Division, Director of Engineering and Operations Staff and Director of Product Management and Business Development for Sprint Southeast Division, as well as Staff Director of Product Services at Sprint Corporation. Mr. Beebe began his career at AT&T/Southwestern Bell as a Manager. Mr. Beebe also serves as chairman of the board of directors of NII Holdings, Inc. (a publicly traded provider of wireless telecommunicationsmobile communication services in Latin America)Brazil), and as a director for SBA Communications Corporation (a publicly traded operator of wireless communications towersinfrastructure in North, Central, and South and Central America) and, Syniverse Technologies, Inc. (a privately held provider of support services for wireless carriers)enterprise messaging solutions), and Logix Communications (a privately held provider of facilities-based communications services).

We believe that Mr. Beebe is qualified to serve as a director because of his 19 yearstwo decades of experience as an operating executive in the wireless telecommunications industry. For example, as Group President of Operations at ALLTEL, he was instrumental in expanding ALLTEL'sALLTEL’s higher margin retail business, which significantly enhanced ALLTEL'sALLTEL’s competitive position in a dynamic, consolidating industry. In addition, as Chief Executive Officer of 2BPartners, LLC, Mr. Beebe continues to gain a broad range of business experience and to build business relationships by advising leading private equity firms that are transacting business in the global capital markets. Mr. Beebe provides cross-board experience by serving as a director for several public and private companies (including service on both audit and governance committees). Further, Mr. Beebe has served as a director of Skyworks since 2004 and has gained significant familiarity with Skyworks'Skyworks’ business.

Timothy R. Furey, age 57,59, has been a director since 1998. He has been Chief Executive Officer of MarketBridge (a privately owned digital marketing software and services firm) since 1991. MarketBridge provides digital marketing, predictive analytics, and sales effectiveness solutions to Fortune 1000 companies in the software, communications, financial services, life sciences, and consumer products sectors. Mr. Furey also serves as Managing Partner of the Technology Marketing Group (which advises and invests in emerging growth companies in the social media, mobile, and marketing automation markets). Prior to 1991, Mr. Furey worked with the Boston Consulting Group, Strategic Planning Associates, Kaiser Associates, and the Marketing Science Institute.

We believe that Mr. Furey is qualified to serve as a director because his experience as Chief Executive Officer of MarketBridge, as well as his engagements with MarketBridge'sMarketBridge’s clients (many of which are Fortune 1000 companies), provide him with a broad range of knowledge regarding business operations and growth strategies. In addition, Mr. Furey has extensive knowledge regarding Skyworks'Skyworks’ business, which he has acquired through over 1719 years of service on the Board of Directors.

Liam K. Griffin, age 51, is President and Chief Executive Officer and a director of the Company. Prior to his appointment as Chief Executive Officer and to the Board of Directors including, forin May 2016, he had served as President since May 2014. He served as Executive Vice President and Corporate General Manager from November 2012 to May 2014, Executive Vice President and General Manager, High Performance Analog from May 2011 to November 2012, and Senior Vice President, Sales and Marketing from August 2001 to May 2011. Previously, Mr. Griffin was employed by Vectron International, a division of Dover Corp., as Vice President of Worldwide Sales from 1997 to 2001 and as Vice President of North American Sales from 1995 to 1997. His prior experience included positions as a Marketing Manager at AT&T Microelectronics, Inc. and Product and Process Engineer at AT&T Network Systems. Mr. Griffin also serves as a director of Vicor Corp. (a publicly traded manufacturer and marketer of modular power components).

We believe that Mr. Griffin is qualified to serve as a director because of his breadth of leadership experience and in-depth understanding of Skyworks’ business gained through serving in several different executive positions at Skyworks over the past 12 years,16 years. Mr. Griffin brings to the Board of Directors strong relationships with Skyworks’ key customers, investors, employees, and other stakeholders, as the Chairmanwell as a deep understanding of the Compensation Committee.semiconductor

| | | | |

| | - Proxy Statement - | | Page 17 |

industry and its competitive landscape. His service as a director for Vicor Corp. gives Mr. Griffin added perspective regarding the challenges confronting public technology companies.

Balakrishnan S. Iyer, age 59,61, has been a director since June 2002. He served as Senior Vice President and Chief Financial Officer of Conexant Systems, Inc., from October 1998 to June 2003. Prior to joining Conexant, Mr. Iyer served as Senior Vice President and Chief Financial Officer of VLSI Technology Inc. Prior to that, he was Corporate Controller for Cypress Semiconductor Corp. and Director of Finance for Advanced Micro Devices, Inc.

|

|

|

|

|

|

|

|

|

|

Mr. Iyer serves on the boards of directors of Power Integrations, Inc. (a publicly traded provider of semiconductor technologies for high-voltage power conversion), QLogic Corporation, and IHS Inc. (each aMarkit Ltd. (a publicly traded company)company that delivers information, analytics and expertise for industries and markets worldwide). He served as a director of Conexant from February 2002 until April 2011, and as a director of Life Technologies Corp. from July 2001 until February 2014, when it was acquired by Thermo Fisher Scientific Inc., as a director of IHS Inc. from December 2003 until July 2016, when it completed a merger with Markit Ltd., and as a director of QLogic Corporation from June 2003 until August 2016, when it was acquired by Cavium, Inc.

We believe that Mr. Iyer is qualified to serve as a director because his experience as an executive officer of companies in the technology industry provides him with leadership, strategic, and financial experience. Through his experiences as a director at the public companies listed above (including as a member of certain audit, governance, and compensation committees) he provides the Board of Directors with significant financial expertise as a designated "audit“audit committee financial expert"expert” for Skyworks'Skyworks’ Audit Committee, bringing specific application to our industry, as well as a broad understanding of corporate governance topics.

Christine King, age 66,68, has been a director since January 2014. Since August 2015, she hasMs. King served as Executive Chairman of QLogic Corporation (a publicly traded developer of high performance server and storage networking connectivity products), where from August 2015 until August 2016, when it was acquired by Cavium, Inc. Previously, she has also been a director since April 2013. Previously, Ms. King served as a director and as Chief Executive Officer of Standard Microsystems Corporation (a publicly traded developer of silicon-based integrated circuits utilizing analog and mixed-signal technologies) from 2008 until the company'scompany’s acquisition in 2012 by Microchip Technology, Inc. Prior to Standard Microsystems, sheMs. King was Chief Executive Officer of AMI Semiconductor, Inc., a publicly traded company, from 2001 until it was acquired by ON Semiconductor Corp. in 2008. From 1973 to 2001, Ms. King held various engineering, business, and management positions at IBM Corp., including Vice President of Semiconductor Products. In addition to serving as chairman of QLogic's board of directors, Ms. King alsocurrently serves as a director of Cirrus Logic, Inc. (a publicly traded provider of integrated circuits for audio and voice signal processing applications), and IDACORP, Inc. (each a(a publicly traded holding company), and as a director of Idaho Power Company (a subsidiary of IDACORP). She previously served as a director of QLogic Corporation, Analog Devices, Inc., and Atheros Communications, Inc., prior to its acquisition by Qualcomm, Inc.

We believe that Ms. King is qualified to serve as a director because of her extensive management and operational experience in the high tech and semiconductor industries. In particular, through her experience as Executive Chairman of QLogic and as Chief Executive Officer of Standard Microsystems and AMI Semiconductor, as well as her service as a director of other public companies, Ms. King provides the Board of Directors with significant strategic, operational, and financial expertise.

David P. McGlade, age 55,57, has been a director since February 2005. He has served as Executive Chairman of Intelsat S.A. (a publicly traded worldwide provider of satellite communication services) since April 2015, prior to which he served as Chairman and Chief Executive Officer. Mr. McGlade joined Intelsat in April 2005 and was the Deputy Chairman of Intelsat from August 2008 until April 2013. Previously, Mr. McGlade served as an Executive Director of mmO2 PLC and as the Chief Executive Officer of O2 UK (a subsidiary of mmO2), a position he held from October 2000 until March 2005. Before joining O2 UK, Mr. McGlade was President of the Western Region for Sprint PCS.

We believe that Mr. McGlade is qualified to serve as a director because of his 32over 30 years of experience in the telecommunications business, which have allowed him to acquire significant operational, strategic, and financial business acumen. Most recently, as a result of his work as the Chief Executive Officer of Intelsat, Mr. McGlade gained significant leadership and operational experience, as well as knowledge about the global capital markets.

| | | | |

Page 18 | | - Proxy Statement - | | |

Robert A. Schriesheim, age 55,57, has been a director since May 2006. He has beenserved as Executive Vice President and Chief Financial Officer of Sears Holdings sincefrom August 2011.2011 to October 2016. From January 2010 to October 2010, Mr. Schriesheim was Chief Financial Officer of Hewitt Associates, Inc. (a global human resources consulting and outsourcing company that was acquired by Aon Corporation). From October 2006 until December 2009, he was the Executive Vice President and Chief Financial Officer of Lawson Software, Inc. (a publicly traded ERP software provider). From August 2002 to October 2006, he was affiliated with ARCH Development Partners, LLC (a seed stage venture capital fund). Before joining ARCH, Mr. Schriesheim held executive positions at Global TeleSystems, SBC Equity Partners, Ameritech, AC Nielsen, and Brooke Group Ltd. Mr. Schriesheim currently serves as a director of Houlihan

|

|

|

|

|

|

|

|

|

|

Lokey Inc. (a publicly traded financial services firm) and NII Holdings, Inc. (a publicly traded provider of wireless telecommunicationsmobile communication services in Latin America)Brazil), and previously served as a director of Lawson Software until its sale in July 2011. In addition, from 2004 until 2007, he was also a director of Dobson Communications Corp. (a former publicly traded wireless services communications company that was acquired by AT&T Inc.) and from 2007 until 2009 he served as a director of MSC Software Corp. (a former publicly traded provider of integrated simulation solutions for designing and testing manufactured products that was acquired by Symphony Technology Group).

We believe that Mr. Schriesheim is qualified to serve as a director because of his extensive knowledge of the capital markets, experience with corporate financial capital structures, and long history of evaluating and structuring merger and acquisition transactions within the technology sector. Mr. Schriesheim also has significant experience, as a senior executive and director in both public and private companies in the technology sector, leading companies through major strategic and financial corporate transformations while doing business in the global marketplace. He also serves as a designated "audit“audit committee financial expert"expert” for Skyworks'Skyworks’ Audit Committee.

| | | | |

| | - Proxy Statement - | | Page 19 |

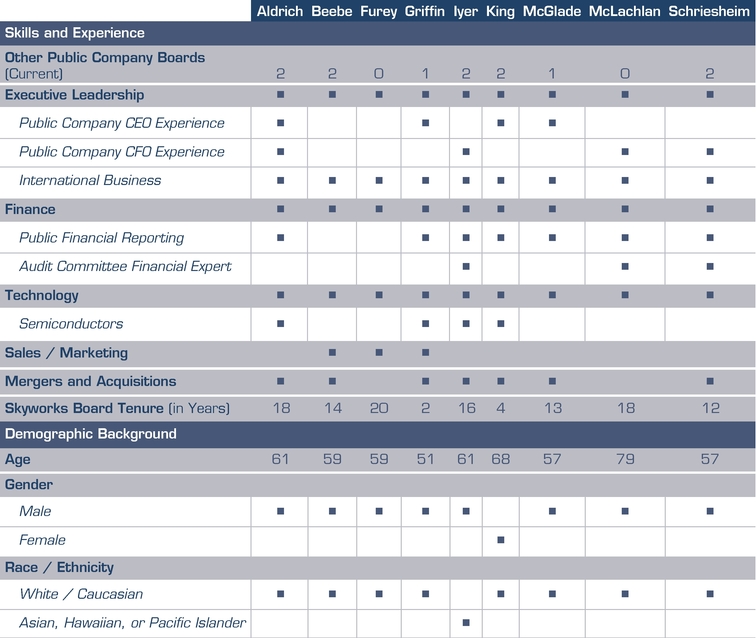

All nine of our currently serving directors have been nominated for reelection to our Board of Directors to serve until the 2019 Annual Meeting of Stockholders and until their successors are elected and qualified or until their earlier resignation or removal. The table below summarizes the key qualifications and attributes relied upon by the Board of Directors in nominating our current directors for reelection. Marks indicate specific areas of focus or expertise relied on by the Board of Directors. The lack of a mark in a particular area does not necessarily signify a director’s lack of qualification or experience in such area.

In addition to the information presented above regarding each director'sdirector’s specific experience, qualifications, attributes and skills that led our Board of Directors to conclude that he or she should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. They have each demonstrated business acumen, an ability to exercise sound judgment, and a commitment of service to Skyworks.

| | | | |

Page 20 | | - Proxy Statement - | | |

General

Board of Director Meetings

The Board of Directors met seven (7)six (6) times during fiscal year 2015.2017. During fiscal year 2015,2017, each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which he or she served. The Company'sCompany’s policy with respect to directors'directors’ attendance at the Annual Meeting is available on the Investor Relations portion of the Company'sCompany’s website athttp://www.skyworksinc.com (see corporate governance guidelines). At the 20152017 Annual Meeting, each director then in office was in attendance, with the exception of Mr. Schriesheim.attendance.

Director Independence

Each year, the Board of Directors reviews the relationships that each director has with the Company and with other parties. Only those directors who do not have any of the categorical relationships that preclude them from being independent within the meaning of the applicable Listing Rules of the NASDAQNasdaq Stock Market LLC (the "NASDAQ Rules"“Nasdaq Rules”) and who the Board of Directors affirmatively determines have no relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, are considered to be independent directors. The Board of Directors has reviewed a number of factors to evaluate the independence of each of its members. These factors include its members'members’ current and historic relationships with the Company and its competitors, suppliers, and customers; their relationships with management and other directors; the relationships their current and former employers have with the Company; and the relationships between the Company and other companies of which a member of the Company'sCompany’s Board of Directors is a director or executive officer. After evaluating these factors, the Board of Directors has determined that a majority of the members of the Board of Directors, namely, Kevin L. Beebe, Timothy R. Furey, Balakrishnan S. Iyer, Christine King, David J. McLachlan, David P. McGlade, and Robert A. Schriesheim, do not have any relationships that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors and that each such director is an independent director of the Company within the meaning of applicable NASDAQNasdaq Rules.

|

|

|

|

|

|

|

|

|

|

Corporate Governance Guidelines

The Board of Directors has adopted corporate governance practices to help fulfill its responsibilities to the stockholders in overseeing the work of management and the Company'sCompany’s business results. These guidelines are intended to ensure that the Board of Directors has the necessary authority and practices in place to review and evaluate the Company'sCompany’s business operations, as needed, and to make decisions that are independent of the Company'sCompany’s management. In addition, the guidelines are intended to align the interests of directors and management with those of the Company'sCompany’s stockholders. A copy of the Company'sCompany’s corporate governance guidelines is available on the Investor Relations portion of the Company'sCompany’s website athttp://www.skyworksinc.com.

In accordance with these corporate governance guidelines, independent members of the Board of Directors of the Company met in executive session without management present four (4) times during fiscal year 2015.2017. Mr. McLachlan, the Lead Independent Director, served as presiding director for these meetings.

Stockholder Communications

Our stockholders may communicate directly with the Board of Directors as a whole or to individual directors by writingletter addressed directly to thosesuch individual or individuals at the following address: c/o Skyworks Solutions, Inc., 20 Sylvan Road, Woburn, MA 01801. The Company will forward to each director to whom such communication is addressed, and to the Chairman of the Board in his capacity as representative of the entire Board of Directors, any mail received at the Company'sCompany’s corporate office to the address specified by such director and the Chairman of the Board.

Code of Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer or

| | | | |

| | - Proxy Statement - | | Page 21 |

controller, or persons performing similar functions. We make available our code of business conduct and ethics through our website athttp://www.skyworksinc.com. We intend to disclose any amendments to, or waivers from, our code of business conduct and ethics that are required to be publicly disclosed by posting any such amendment or waivers on our website pursuant to SEC requirements and NASDAQNasdaq Rules.

Executive Officer and Director Stock Ownership Requirements

As described in detail below under "“Compensation Discussion and Analysis,"” we have adopted Executive Officer and Director Stock Ownership programs that require our executive officers (including ourthose Named Executive Officers)Officers who are still currently serving as executive officers) and non-employee directors to hold a significant equity interest in Skyworks with the objective of more closely aligning the interests of our executive officers and directors with those of our stockholders. As of the date hereof, allAll of our Named Executive Officers and directors are in compliance withhave met the stock ownership guidelines.guidelines as of the date hereof, with the exception of Mr. Sennesael (who has until the third anniversary of the date he assumed his current position to meet the stock ownership guidelines).

Board Leadership Structure

Our Board of Directors selects the Company'sCompany’s Chairman of the Board and Chief Executive Officer in the manner it determines to be in the best interests of the Company. In May 2014, our Board of Directors electedappointed Mr. Aldrich, who had previously served as the Company'sCompany’s President and Chief Executive Officer, to serve as Chairman of the Board and Chief Executive Officer.Officer, and in May 2016, our Board of Directors appointed Mr. Aldrich to serve as Chairman of the Board and Executive Chairman. At the time of Mr. Aldrich's electionAldrich’s appointment as Chairman of the Board in May 2014, our Board of Directors appointed Mr. McLachlan, the prior Chairman of the Board and an independent director within the meaning of applicable NASDAQNasdaq Rules (see above under "“Director Independence"”), as the Lead

|

|

|

|

|

|

|

|

|

|

Independent Director. At the time of Mr. McLachlan'sAldrich’s appointment as Executive Chairman in May 2016, our Board of Directors appointed Mr. Griffin to serve as President and Chief Executive Officer and elected Mr. Griffin to serve as a director. Mr. McLachlan’s duties as Lead Independent Director, as set forth in our corporate governance guidelines, include the following:

The Board believes our current leadership structure is appropriate and that the duties of the Lead Independent Director appropriately and effectively complement the duties of the Chairman of the Board.

| | | | |

Page 22 | | - Proxy Statement - | | |

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee.

Audit Committee

We have established an Audit Committee consisting of the following individuals, each of whom the Board of Directors has determined is "independent"“independent” within the meaning of applicable NASDAQNasdaq Rules and meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”): Messrs. Schriesheim (Chairman), Beebe, Iyer, and McLachlan.

The primary responsibility of the Audit Committee is the oversight of the quality and integrity of the Company'sCompany’s financial statements, the Company'sCompany’s internal financial and accounting processes, and the independent audit process. Additionally, the Audit Committee has the responsibilities and authority necessary to comply with Rule 10A-3 under the Exchange Act. The Audit Committee meets privately with the independent registered public accounting firm, reviews their performance and independence from management, and has the sole authority to retain and dismiss the independent registered public accounting firm. These and other aspects of the Audit Committee'sCommittee’s authority are more particularly described in the Company'sCompany’s Audit Committee Charter, which the Board of Directors adopted and is reviewed annually by the committee and is available on the Investor Relations portion of our website athttp://www.skyworksinc.com.

The Audit Committee has adopted a formal policy concerning approval of audit and non-audit services to be provided to the Company by its independent registered public accounting firm, KPMG LLP. The policy requires that all services provided by KPMG LLP, including audit services and permitted audit-related and non-audit services, be

|

|

|

|

|

|

|

|

|

|

preapproved by the Audit Committee. The Audit Committee preapproved all audit and non-audit services provided by KPMG LLP for fiscal year 2015.2017. The Audit Committee met ten (10)twelve (12) times during fiscal year 2015.2017.

Audit Committee Financial Expert

The Board of Directors has determined that each of Messrs. Schriesheim (Chairman), Iyer, and McLachlan, meets the qualifications of an "audit“audit committee financial expert"expert” under SEC rules and the qualifications of "financial sophistication"“financial sophistication” under the applicable NASDAQNasdaq Rules, and qualifies as "independent"“independent” as defined under the applicable NASDAQNasdaq Rules. The Board of Directors has also determined that Ms. King and Mr. McGlade each would meet the qualifications of an "audit“audit committee financial expert"expert” under current SEC rules and the qualifications of "financial sophistication"“financial sophistication” under current NASDAQNasdaq Rules if appointed to serve on the audit committee in the future.

Compensation Committee

We have established a Compensation Committee consisting of the following individuals, each of whom the Board of Directors has determined is "independent"“independent” within the meaning of applicable NASDAQNasdaq Rules: Ms. King (Chairman) and Messrs. Beebe, Furey, (Chairman), Beebe, and McGlade and Ms. King.McGlade. The Compensation Committee met four (4)five (5) times during fiscal year 2015.2017. The functions of the Compensation Committee include establishing the appropriate level of compensation, including short and long-term incentive compensation of the Chief Executive Officer, all other executive officers, and any other officers or employees who report directly to the Chief Executive Officer. The Compensation Committee also administers Skyworks'Skyworks’ equity-based compensation plans. The Compensation Committee'sCommittee’s authority to grant equity awards to the Company'sCompany’s executive officers may not be delegated to the Company'sCompany’s management or others. The Board of Directors has adopted a written charter for the Compensation Committee, and it is available on the Investor Relations portion of the Company'sCompany’s website athttp://www.skyworksinc.com.

The Compensation Committee has engaged Aon/Radford Consulting ("(“Aon/Radford"Radford”) to assist it in determining the components and amounts of executive compensation. The consultant reports directly to the Compensation Committee, through its Chairman, and the Compensation Committee retains the right to terminate or replace the consultant at any time.

| | | | |

| | - Proxy Statement - | | Page 23 |

The process and procedures followed by the Compensation Committee in considering and determining executive and director compensation are described below under "“Compensation Discussion and Analysis."”

Nominating and Corporate Governance Committee

We have established a Nominating and Corporate Governance Committee consisting of the following individuals, each of whom the Board of Directors has determined is "independent"“independent” within the meaning of applicable NASDAQNasdaq Rules: Messrs. Iyer (Chairman), Furey, McGlade, and McLachlan. The Nominating and Corporate Governance Committee met four (4)three (3) times during fiscal year 2015.2017. The Nominating and Corporate Governance Committee is responsible for evaluating and recommending individuals for election or reelection to the Board of Directors and its committees, including any recommendations that may be submitted by stockholders, the evaluation of the performanceannual self-evaluations of the Board of Directors and its committees, and the evaluation and recommendation of the corporate governance policies. These and other aspects of the Nominating and Corporate Governance Committee'sCommittee’s authority are more particularly described in the Nominating and Corporate Governance Committee Charter, which the Board of Directors adopted and is available on the Investor Relations portion of the Company'sCompany’s website athttp://www.skyworksinc.com.

Director Nomination Procedures

The Nominating and Corporate Governance Committee evaluates director candidates in the context of the overall composition and needs of the Board of Directors, with the objective of recommending a group that can best

|

|

|

|

|

|

|

|

|

|

manage the business and affairs of the Company and represent the interests of the Company'sCompany’s stockholders using its diversity of experience. The committee seeks directors who possess certain minimum qualifications, including the following:

| | | | |

Page 24 | | - Proxy Statement - | | |

The committee does not have a formal policy with respect to diversity, but believes that our Board of Directors, taken as a whole, should embody a diverse set of skills, experiences, and backgrounds in order to better inform its decisions. The committee will also take into account the fact that a majority of the Board of Directors must meet the independence requirements of the applicable NASDAQNasdaq Rules. The Company expects that a director'sdirector’s existing and future commitments will not materially interfere with such director'sdirector’s obligations to the Company. For candidates who are incumbent directors, the committee considers each director'sdirector’s past attendance at meetings and participation in and contributions to the activities of the Board of Directors. The committee identifies candidates for director nominees in consultation with the Chief Executive Officer of the Company and the Chairman of the Board of Directors, through the use of search firms or other advisors or through such other methods as the committee deems to be helpful to identify candidates. Once candidates have been identified, the committee confirms that the candidates meet all of the minimum qualifications for director nominees set forth above through interviews, background checks,

|

|

|

|

|

|

|

|

|

|

or any other means that the committee deems to be helpful in the evaluation process. The committee then meets to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board of Directors. Based on the results of the evaluation process, the committee recommends candidates for director nominees for election to the Board of Directors.

Stockholder Nominees

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders provided thesuch stockholders follow the procedures set forth below. The committee does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether the candidate was recommended by a stockholder or otherwise. To date, the Nominating and Corporate Governance Committee has not received a recommendation for a director nominee from any stockholder of the Company.

Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nomineesnominate director candidates for election at the 2019 Annual Meeting, but who are not to be included in the Company’s proxy materials pursuant to the Board of Directorsproxy access provisions in 2017our By-laws, may do so in accordance with the provisions of our By-laws by submitting a written recommendation to the Secretary of the Company at the address below no earlier than the close of business on January 11, 2017,9, 2019, and no later than the close of business on February 10, 2017.8, 2019. In the event that the 20172019 Annual Meeting is held more than thirty (30) days before or after the first anniversary of the Company's 2016Company’s 2018 Annual Meeting, then the required notice must be delivered in writing to the Secretary of the Company at the address below no earlier than 120 days prior to the date of the 20172019 Annual Meeting and no later than the later of 90 days prior to the 20172019 Annual Meeting or the 10th day following the day on which the public announcement of the date of the 20172019 Annual Meeting is first made by the Company. For nominees for election to the Board of Directors proposed by stockholders to be considered, the recommendation for nomination must be in writing and must include the following information:

Nominations may be sentA stockholder (or a group of up to the attentiontwenty stockholders) who has owned at least three percent of the committee via U.S. mail or expedited delivery service to Skyworks Solutions, Inc., 20 Sylvan Road, Woburn, Massachusetts 01801, Attn: NominatingCompany’s outstanding shares of common stock continuously for at least three years, and Corporate Governance Committee, c/o Secretary.has complied with the other

| | | | |

| | - Proxy Statement - | | |

requirements in the Company’s By-laws, may nominate and include in the Company’s proxy materials a number of director nominees up to the greater of two individuals or 20% of the Board of Directors. Written notice of a proxy access nomination for inclusion in our proxy statement for the 2019 Annual Meeting of Stockholders must be submitted to the Secretary of the Company at the address below no earlier than the open of business on December 10, 2018, and no later than the close of business on January 9, 2019. In the event that the 2019 Annual Meeting is held more than thirty (30) days before, or more than sixty (60) days after, the first anniversary of the Company’s 2018 Annual Meeting, then the required notice must be delivered in writing to the Secretary of the Company at the address below no earlier than 150 days prior to the date of the 2019 Annual Meeting and no later than the later of 120 days prior to the 2019 Annual Meeting or the 10th day following the day on which the public announcement of the date of the 2019 Annual Meeting is first made by the Company.

Written notice of proxy access nominations and written recommendations for nomination may be sent to the General Counsel and Secretary of the Company via U.S. mail or expedited delivery service to Skyworks Solutions, Inc., 5221 California Avenue, Irvine, California 92617.

Role of the Board of Directors in Risk Oversight

Our Board of Directors oversees our risk management processes directly and through its committees. Our management team is responsible for risk management on a day-to-day basis. The role of our Board of Directors and its committees is to oversee the risk management activities of our management team. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our Board of Directors oversees risk management activities relating to business strategy, capital allocation, organizational structure, certain operational risks, and acquisitions; our Audit Committee oversees risk management activities related to financial controls and legal and compliance risks; our Compensation Committee oversees risk management activities relating to our compensation policies and practices as well as management succession planning; and our Nominating and Corporate Governance Committee oversees risk management activities relating to Board composition. Each committee reports to the Board of Directors on a regular basis, including reports with respect to the committee'scommittee’s risk oversight activities as appropriate. In addition, since risk issues often overlap, committees from time to time request that the Board of Directors discuss particular risks.

Our Compensation Committee does not believe that any risks arising from our employee compensation policies and practices are reasonably likely to have a material adverse effect on our company. Our Compensation Committee believes that any such risks are mitigated by:

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors currently consists of, and during fiscal year 20152017 consisted of, Ms. King (Chairman) and Messrs. Beebe, Furey, (Chairman), Beebe, and McGlade and Ms. King.McGlade. No member of this committee was at any time during fiscal year 20152017 an officer or employee of the Company, was formerly an officer of the Company or any of its subsidiaries, or had any employment relationship with the Company or any of its subsidiaries. No executive officer of the Company has served as a director or member of the compensation committee (or other committee serving an

| | | | |

Page 26 | | - Proxy Statement - | | |

equivalent function) of any other entity, one of whose executive officers served as a director of or member of the Compensation Committee.

Certain Relationships and Related Person Transactions

Other than compensation agreements and other arrangements described below under "“Information About Executive and Director Compensation,"” since October 3, 2014,1, 2016, there has not been a transaction or series of related transactions to which the Company was or is a party involving an amount in excess of $120,000 and in which any director, executive officer, holder of more than five percent (5%) of any class of our voting securities, or any member of the immediate family of any of the foregoing persons, had or will have a direct or indirect material interest. In January 2008, the Board of Directors adopted a written related person transaction approval policy that sets forth the

|

|

|

|

|

|

|

|

|

|

Company's Company’s policies and procedures for the review, approval or ratification of any transaction required to be reported in its filings with the SEC. The Company'sCompany’s policy with regard to related person transactions is that all related person transactions between the Company and any related person (as defined in Item 404 of Regulation S-K) or their affiliates, in which the amount involved is equal to or greater than $120,000, be reviewed by the Company'sCompany’s General Counsel and approved in advance by the Audit Committee. In addition, the Company'sCompany’s code of business conduct and ethics requires that employees discuss with the Company'sCompany’s Compliance Officer any significant relationship (or transaction) that might raise doubt about such employee'semployee’s ability to act in the best interest of the Company.

|

|

|

|

|

|

|

|

|

|

Proposal 2:

Ratification of Independent

Registered Public Accounting Firm

The Audit Committee has selected KPMG LLP as the Company'sCompany’s independent registered public accounting firm for fiscal year 20162018 and has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. KPMG LLP was the independent registered public accounting firm for the Company for fiscal year 2015,2017, and has been the independent registered public accounting firm for the Company and its predecessor, Alpha Industries, Inc., since 1975. We are asking the stockholders to ratify the selection of KPMG LLP as the Company'sCompany’s independent registered public accounting firm for fiscal year 2016.2018.

Representatives of KPMG LLP are expected to attend the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate stockholder questions.